The topic of recycling in venture capital has come up a lot recently, mainly in talking to GPs who are either (1) thinking about raising a first fund, or (2) raising a second or third fund, while looking to transition to a more institutional LP base. With a ton of things to worry about, recycling seems to that gets de-prioritized for GPs at this stage – that is a mistake.

Roger Ehrenberg of IA Ventures and Brad Feld of Foundry have both outlined their views on recycling (they like it); my goal here is to succinctly lay out the issue and the math behind it.

The problem – If you have a $100M fund and assume (for simplicity) that you charge a 2% management fee over a 10 year investment period, you end up with $80M to invest in companies, with the remaining $20M going to the management fee. Thus, even if you deploy that entire $80M, you are only investing 80% of the fund. VCs are judged on net returns to LPs, so investing only $80M is putting yourself at a disadvantage right out of the gate (on $80M invested, you need to return 1.25x just to return the $100M fund).

The Solution – Recycling. In the case of an early liquidity event (let’s say a $20M exit), that capital can either be distributed to LPs or recycled back into companies. S0, if you have a $100M fund, and recycle that early $20M return, you know have $100M to invest into companies out of your $100M fund (the initial $80M plus the recycled $20M). Taking this a step further, if you are able to recycle $40M in early returns, you could potentially have $120M (original $80M plus $40M in recycling) to invest out of your $100M fund – you’re already $20M “in the money” at cost! From the funds I’ve seen, 120% is a pretty common recycling ceiling in fund documents.

So why doesn’t everyone do it? In general, established/successful funds managers know how this works and aim to get over 100% invested, if possible. The main problem I’ve seen is with funds who scraped together their own capital and an HNWI-heavy LP base for an early fund(s), and who are now hoping to raise from more traditional LPs (e.g. fund of funds and endowments). Venture capital is a long term game, and institutions with that time horizon prefer to plow early returns back into companies, getting as much out of their fund commitment as possible. Less experienced GPs and individual investors could potentially be more interested in an early payout, creating a conflict of interest. While LPs will have different opinions on recycling, GPs who don’t aim to maximize the dollars put to work in companies are doing themselves a disservice and hurting the financial return for both themselves and their LPs.

The Math

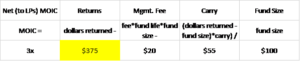

To get a 3x net return to LPs on a $100M fund, assuming an annual 2% management fee over 10 years ($20M) and 20% carry ($55M), you need to produce $375M in returns.

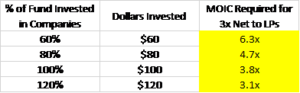

So, on a gross basis (at the company level), here is what you have to return at different percent invested levels:

Notice that, without recycling, to generate a 3x net return without recycling (investing $80M), you need a gross return of 4.7x. Compare that to the scenario where you invest $120M, needing only a 3.1x return. That is an incredibly large difference, and it is all due to recycling.

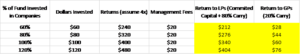

Looking at it a different way, assume that you are able to return 4x gross (congrats!) on any amount of deployed capital:

On a gross return basis, each of these scenarios is equal, but comparing the extreme cases of 60% and 120% invested, you get a $192M and $48M swing in payouts for LPs and GPs, respectively.

There are, of course, assumptions above (early liquidity opportunities, recycled dollars being put to work effectively, etc.), but the point remains – recycling benefits both GPs and LPs, and it is critical for fund managers to build an LP base with aligned, long term incentives.

Good stuff, John. As someone coming from the LP side I have a slightly different take. We were a fund of funds, so “institutional” in some ways, but not all look alike, and that is sort of a key to this conversation, as you note the LP base needs to be aligned of course.

But for starters, I’m not so sure we would’ve liked our venture funds to recycle actually. It mostly comes down to cash, and how long it takes to see that coveted DPI.

To contrast, we were happy to grant more generous recycling rights to funds that were going to make investments with shorter lifespans, deals that were maybe lower on the risk spectrum, targeting lower multiples but solid IRRs. These were things like some special credit, maybe mezzanine, distressed-for-control. They were situations where the fund may put money to work on Day 1, and a deal might be exited after a year, maybe two. So instead of making the manager send all that money back to LPs, and making them fundraise even more often than they already have to, you grant them recycling rights.

With venture, investment duration and growing fund lives are a pretty big issue. Funds say they’ll wrap up in 10 years, or 12, with their “optional” extensions, but they generally don’t surprise you to the earlier end. If venture managers were granted recycling rights, it would just make this problem worse. It’s not as if a venture fund is collecting distributions earlier in the fund’s life. Granted, later-stage funds (and quasi-growth funds like Brad Feld’s Foundry Select Fund) can create a path to cash sooner than later.

A secondary reason you may not want to allow that much recycling is that a critical factor in trying to project a fund’s performance is a proper match of team/strategy and capital. LPs enforce caps on fund sizes for a reason; they don’t want to put too much on a manager. Plus, they want to see manager perform with what they were given, earn their carry, and come back for more money. If they were spending time recycling their capital later in the fund’s life, an LP loses a little control of that feedback loop.

Thanks, Michael R – appreciate the feedback!

I don’t have a lot of experience with the shorter term, “lower multiples but solid IRR” funds you mention above, so I won’t dive into that. It does sound like your reasoning for recycling there makes sense.

I’ll continue to disagree with you on VC recycling – and here is why:

You say that “With venture, investment duration and growing fund lives are a pretty big issue. Funds say they’ll wrap up in 10 years, or 12, with their “optional” extensions, but they generally don’t surprise you to the earlier end. If venture managers were granted recycling rights, it would just make this problem worse.”

I’m not sure I understand “the problem” here. Returns being equal, I agree that an earlier check is better than a later one, but with venture being a long term bet, I am always focused on multiple on invested capital (MOIC). Thinking strictly as an institutional LP, I would much rather take an early exit and plow it back into companies than get a quick return with great IRR on a small piece of my commitment (as an LP, I would suggest you do secondary investments if you are looking to mitigate your own J-curve – that actually may be a good topic for a future post). Again, looking at the math of a $100M fund with $20M in management fees, 1/5 of an LP’s committed capital is dead money from the start without recycling. If I am an LP, I want every bit of my committed capital (and hopefully more) invested in startup equity with huge upside potential.

In my experience, fund extensions are generally not a big issue, and an institutional LP is likely to be invested in succeeding funds (given good performance), continuing that relationship; if follow-on capital is being smartly (e.g. on strategy) invested in follow-on rounds in years 10-13, I’m OK with that.

When it all comes out in the wash, VC funds (and their LPs) will be benchmarked again net returns from other VC funds, so investing 100%+ of committed capital should always be a good bet, unless you don’t think the fund managers can put that capital to work effectively; if that’s the case, as an LP you’ve already made a massive error in judgement and there are other issues to address. Forgetting about early liquidity that ultimately isn’t going to move the needle (for either the VC fund or the LP’s presumably large portfolio) and focusing on long term return multiples is, in my opinion, the best way to invest in venture.

There are certainly LPs and GPs who focus on early liquidity, but neither are optimizing on venture performance; these are not funds I would want to work with. If you want liquidity in your portfolio, venture is not the asset class for you anyways.

As for your secondary point, the same idea holds. If I invest $10M in a fund, and I have the choice between $10M or $8M being put to work in portfolio companies, I will always want the former. Per the post, it’s really just math.

Your point on fund size as critical is well taken, and certainly should be accounted for in diligence on the strategy and team. Again, however, if I’m investing $10M, the “increase” in fund size from $8M to $10M should really only help returns (for both GPs and LPs), and if you don’t think the fund manager can deploy this capital effectively, I would say that you should not have invested in the first place.